It is also possible to make an interim claim – based on estimated provisional amount lost and not the one actually incurred. In other words, self-assessed individuals with unused wear and tear allowances for plant and machinery or writing-down allowances for industrial buildings, structures and farm buildings can also deduct 2020 losses from 2019 profits.

The €25,000 limitation applies to both trading losses and capital allowances. The relief is available to individuals carrying out a trade or profession, either as sole traders or in partnerships. However, under the new scheme, losses of up to €25,000 from the 2020 tax year can be deducted from 2019 profits.

In previous years, where a self-assessed individual incurs a loss for a year of assessment, that loss could only be carried forward and set against the profits of the following tax year. Revenue have announced that self-employed individuals can claim to have their 2020 losses and certain unused capital allowances carried back and deducted from their 2019 tax year profits - reducing the amount of income tax payable on those profits. Self-employed individuals can now use 2020 losses against 2019 profits

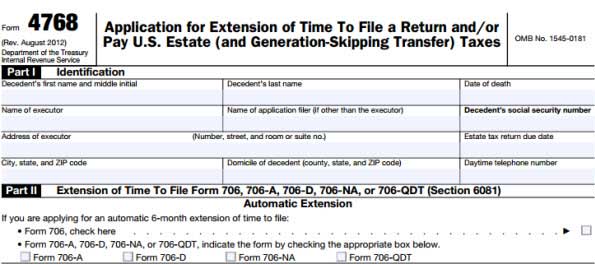

TAX FILE EXTENSION FREE

Taxpayers who do not intend to pay and file online cannot avail of the extension and must adhere to the 31 October deadline.įinally, if you are a beneficiary of a gift or inheritance with a valuation date in the year ended 31 August 2020, you will also have until 10 December to make a Capital Acquisitions Tax (CAT) return and pay your tax liability.ĭownload your FREE Self-Assessed Irish Tax Guide "Any assistance at all that the can be provided to business owners throughout Ireland to allow them time to get back on their feet must be welcomed," said Marian Ryan, consumer tax manager at. The extension will come as welcome news for countless businesses across Ireland. Revenue has announced that the deadline for 2019 self-assessed income tax returns and 2020 preliminary tax payments has been extended to 10 December. Self-assessed taxpayers will now have an extra four weeks to file their tax return in 2020.

TAX FILE EXTENSION HOW TO

How to file your tax return easily online.Self-employed individuals can now deduct 2020 losses from 2019 profits – reducing tax bill.

0 kommentar(er)

0 kommentar(er)